Meet the unique operational and compliance requirements of decentralized finance with automated due diligence, powered by the industry's broadest blockchain coverage and next-generation cross-chain screening solutions. Assess counterparties, monitor liquidity pools, and screen wallet interactions for links to sanctioned entities or illicit activity. Lenix Protocol's solutions are designed for decentralized protocols, enabling risk management without compromising the principles of DeFi.

Apply customizable risk scores to keep the focus on the highest risks and minimize resource-intensive investigations, so compliance does not interrupt growth opportunities.

Leverage the industry's most reliable and precise APIs to optimize and automate compliance, even as the volume of AML screening requests increases.

Tap blockchain-native data in real-time, with intelligence across thousands of tokens across Layer 1s and Layer 2s to measure and mitigate risk.

Perform proactive due diligence across the ecosystem, ensuring regulatory compliance while protecting partners and securing end-user experiences.

Lenix Protocol's broad asset and network coverage enables comprehensive activity evaluations. Our digital asset coverage includes mainstream networks like Bitcoin and Ethereum, stablecoins, ERC-20 tokens and memecoins.

Enable audit-ready, scalable compliance across the decentralized finance system with our robust, reliable API.

Assess crypto wallets and transactions for connections to criminal money laundering, terrorist financing, and sanctioned entities and get the clear insights that drive fast, decisive action to protect assets.

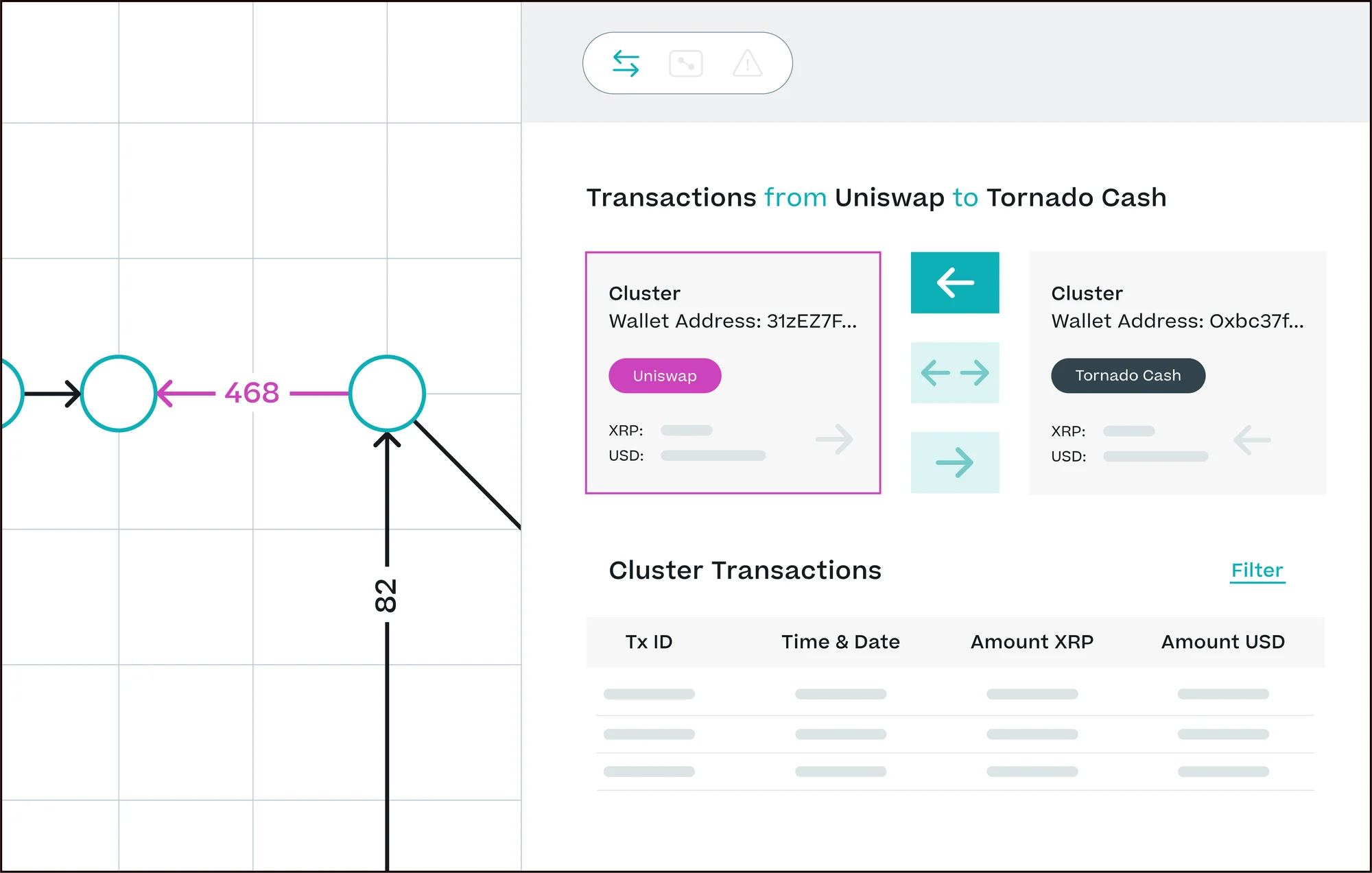

Monitor crypto and decentralized financial transactions across the ecosystem, tracing activity across all tradable chains and assets for a holistic assessment of your risk exposure. Lenix Protocol's solutions adapt to innovations in DeFi, monitoring activity governed by smart contracts and ensuring compliance as protocols evolve.

Manage risk and ensure compliance during the onboarding process with integrated tools that provide a comprehensive view of an entity's activity across all major blockchains and assets. Identify exposure across liquidity providers, liquidity pools, and decentralized exchanges to surface hidden risks.

Streamline compliance and reduce risk with in-depth analysis of token usage and asset behavior. Map DeFi protocols' connections across the crypto ecosystem to identify counterparties, liquidity pool exposure, and links to mixers or high-risk exchanges.